5 Best Accounting Software for Small Businesses: Integrate With Digital Checks

Imagine your staff using a business accounting software program for making transactions. It helps manage your firm’s finances, but you’re struggling to pay contractors and vendors on time. The reason? It can take hours and days to write, print, and stuff checks into envelopes in-house. Hence, consider using QuickBooks Online printing checks integration to save time and money.

It is a common scenario for many businesses. Accounting software, such as QuickBooks and others, helps track expenses and generate invoices. Yet, sending check payments can still feel like an annoying old-school process. The disconnect slows down operations and increases the risk of mistakes.

In this blog, we’ll explore the Intuit QuickBooks Online printing checks integration. We will discover how integrating digital checks with accounting software simplifies business payments! Let’s dive in!

Key Takeaways:

- Electronic check payments, or eChecks, are like paper checks. But you manage and send them online. No printing your checks in the office, no mailing, no hassle.

- You can speed up payments by integrating digital checks into your accounting software.

- You need a reliable check API, like PostGrid, to help you integrate QuickBooks and eChecks. It allows you to reduce the number of manual steps and automate tasks using an online solution.

- The QuickBooks Online printing checks allow you to streamline payments. Thus, you can ensure you don’t have to pay interest or late fees.

Advantages of Using Digital Checks for Business Payments

Digital checks are an electronic version of traditional paper checks. Businesses can use this convenient method to send payments from their bank accounts. Key advantages include:

- Faster payment processing compared to mailing physical checks

- Reduced reliance on paper, postage, and manual handling

- Trackable and auditable payment trails

- Ability to pay bills to vendors and contractors who still prefer check payments

Why Integrate Digital Checks With Small Business Accounting Software

Streamline Bill Payments

Businesses can send check payments to clients, suppliers, etc., using their accounting software. They don’t need to switch between different platforms or printers. Thus, they don’t need to fetch the payee details. You also don’t need to fill out the checks or print them.

For example, imagine using PostGrid’s eChecks integration with accounting software. It allows you to create ready-to-mail checks within your current workflow. Thus, you can gain more control and flexibility over your processes.

Send Out Fast Payments

It can take a lot of time for accounting teams to write, print, and send checks to the intended payees. Additionally, setting up the printer to print voucher checks, pay stubs, etc., can be hard. You can integrate digital checks with accounting software to cut down this time and:

- Automate recurring payments

- Batch process vendor payments

- Schedule future-dated checks

Boost Accuracy

The API can pull check details from your accounting software. There is no manual intervention that could lead to errors. Hence, you can reduce mistakes, like incorrect amounts or recipient details. Additionally, solutions like PostGrid let you cross-check mailing addresses while sending digital checks. It helps cut mail returns.

Enhance Fraud Protection

Digital platforms for Intuit QuickBooks Online printing checks incorporate bank-level encryption. They also use positive pay and secure user authentication. It reduces the risk of fraud. Thus, it is a crucial upgrade over traditional checks, which are easier to forge or intercept.

What Factors Should Businesses Consider When Choosing Accounting Software to Print Digital Checks?

Check Volume

Consider whether the check Print & Mail solution can help you send bulk check payments. Verify whether the tool offers volume-based discounts. Also, ensure it lets you send the checks online without technical glitches or delays.

Security and Compliance

Select a tool for eCheck integration with accounting software incorporating adequate security measures. These are crucial to protect you and your clients’ financial data. It should provide end-to-end encryption, user authentication, and permission settings. These measures ensure that only authorized personnel can access your account. Furthermore, the solution should follow HIPAA, PCI DSS, PIPEDA, SOC-2, etc.

Technical Support

You will need some technical expertise despite the native zero-code integration. Hence, businesses must select a solution for Intuit QuickBooks Online printing checks. This tool should provide 24/7 support and API documentation to help them get going.

Total Costs

Many Print & Mail platforms charge a small amount, regardless of the number of checks. But you may end up paying way more than you need. Thus, it is best to choose a solution that offers monthly and yearly plans. It allows you to select the volume and features you need and only pay for those that you use.

Top 5 Accounting Software for Small Businesses

#1 QuickBooks Online

Most businesses, freelancers, and online merchants use Intuit QuickBooks Online. This accounting software allows them to handle bookkeeping tasks fast. The best part is that this solution is cost-effective and easy to use. Hence, most companies rely on it for its basic tools and navigable dashboard.

You can integrate QuickBooks with over 150 other applications or platforms. It enables you to use several processes under one tool to streamline operations.

Key Highlights:

- Quick payment reconciliation

- Integration with significant payments gateways

- Direct ACH business payments

- Low pricing for basic tools

- Digital check options

- Real-time tracking capabilities for personal and business payments

#2 Wave Accounting

Wave Accounting is among the top accounting software programs for business owners. You can start right after entering your email and some basic information. The simple design makes it quick to learn for beginners.

But managing the cash flow can be stressful, so ease of use isn’t enough. Wave Accounting helps users by syncing their data. It also has ready-made templates, which is great if you’re not used to financial reports.

Additionally, the software application has partnered with many third-party tools and products. Hence, you can get extra features at significant discounts and perks. Wave is free, but that comes with trade-offs. You don’t get customer support unless you pay. It also lacks payroll features and displays ads to recover revenue.

Key Highlights:

- User-friendly dashboard for accountants

- Limited functionality

- Lack of customer support

- High number of advertisements

- Partnerships and discount offers

- Free to use

- Send invoices and checks via integrations

#3 FreshBooks

If you run a small business, you’re always on the move. But your accounting tasks don’t stop because you’re not in the office. That’s where good mobile accounting software and mobile application can help. FreshBooks offers both software and a mobile app for one monthly fee. The app is simple to use, with clear buttons and a straightforward layout. It makes accounting less of a hassle.

You can create invoices and track expenses right from your phone or tablet. This accounting software helps you stay on top of your finances no matter where you are. Also, its customer support is responsive, prompt, and helpful.

But there are some downsides. The app is only compatible with iOS and Android. Also, some tools are only available through the website, which can limit the app’s usefulness.

Key Highlights:

- Quick ACH payments

- Customer credit card storage

- Easy-to-use tools for business needs

- Mobile-friendly interface

- Detailed payment history

- Mobile payment acceptance

- Limited supported platforms

#4 Sage 50cloud

You can integrate digital checks into this accounting software program. It is commonly used by medium-scale businesses and has advanced bookkeeping capabilities. Companies can store financial information in the cloud for secure access. Hence, you don’t need to worry about losing data during a crash.

Sage has three software plans for businesses of different sizes. Its user-friendly tools are perfect for beginners and experts.

Key Highlights:

- Process multiple payments

- Vendor ACH payments

- Schedule bill payments in advance

- Audit trias

- Electronic remittance advice

- Cloud Storage

#5 Xero

The Xero accounting software lets businesses process national and international business payments. It helps you combine over 450 third-party tools with the software program. Furthermore, Xero offers 24/7 customer support to help its users.

This accounting software enables seamless data transfer from other platforms. Additionally, Xero offers quick and automatic updates and seamless connections to bank systems.

Key Highlights:

- Multi-currency support

- Custom payment schedules

- Automated bank feeds

- Recurring billing options

- High-tech security protocols

How to Set Up QuickBooks Accounting Software to Print a Check Online Via PostGrid Integration?

Integrating PostGrid’s check service with QuickBooks Online printing checks can be a seamless process. Here’s a quick setup guide:

- Sign Up and Create an Account on PostGrid

- Access the dashboard and generate your API key to send checks in QuickBooks Online.

- Connect QuickBooks Online

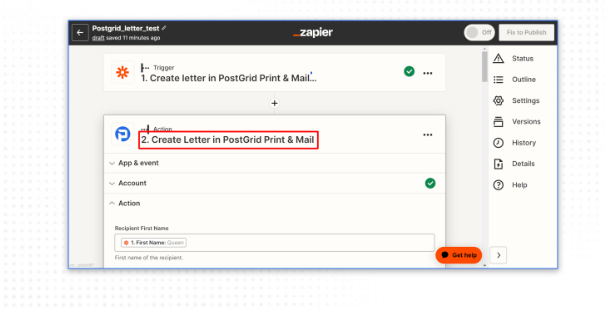

- Use a connector like Zapier or direct API integration to sync payment data.

- Map Payee and Payment Fields

- Ensure that fields such as payee name, address, and amount match between systems.

- Set Up Webhooks for Payment Triggers

- Automate check generation based on invoice approvals or due dates in QuickBooks.

- Customize Check Templates

- Use PostGrid’s interface to brand your checks and set layout preferences whenever you want to print the check. You can even add the number of the first check in the checkbox if you want to start a sequence. Thus, you can reconcile with your accounting systems.

- Start Sending

- Once you have configured QuickBooks and eChecks, you can print checks in QuickBooks Online. This way, PostGrid handles all the steps on your behalf.

PostGrid: Send Digital Checks Through Your Cloud Accounting Software

PostGrid offers an all-in-one printing and mailing solution that allows businesses to:

- Print QuickBooks checks on demand and in bulk.

- Automate mailing with USPS.

- Integrate with accounting tools like QuickBooks.

- View the check delivery and payment status via the dashboard analytics.

All you need to do is create an account and select a plan that best suits your needs. You can also add more than one bank account. Switch between them to send check payments. And you never have to worry about setting up an office printer or a print queue ever again!

Click here to sign up and get started with using QuickBooks and eChecks integration now!

Frequently Asked Questions

Which Accounting Software to Use to Print Digital Checks?

Several accounting software platforms offer check printing, including:

- Intuit QuickBooks Online & Desktop

- Xero (with integrations)

- Zoho Books

- Sage Accounting

What Is Digital Check and Accounting Software Integration?

This integration enables businesses to send online checks from their accounting software. A solution, such as PostGrid Print & Mail, helps you create, print, and send checks in an automated manner. Thus, your business can save time, costs, and manual effort. You don’t need to buy an office printer or struggle with the print settings. This solution lets QuickBooks users create checks to print later or instantly based on their needs.

How Can PostGrid Help Print Checks Online?

PostGrid lets you choose check templates, customize the details, and add your digital signature. Hence, you can create eChecks without worrying about print setup. Once created, you can place your orders. PostGrid can print and send the checks to any recipients.