How to Use a Medical Necessity Letter Sample?

Health insurance policies provide various products and services. Individuals can avail of hospital stays, medical equipment, and prescription medications. The majority of these plans offer coverage only for health-related services that come under absolute necessity.

Individuals prefer using a health savings account (HSA) or flexible spending account (FSA) to pay for some services that their insurance doesn’t cover. However, if the IRS doesn’t consider these expenses qualified, you must draft a letter of medical necessity from your provider.

For example, an insurance policy might not cover vitamins, supplements, or exercise equipment expenses. You need to spend on your own and bear these charges. A medical necessity letter verifies that the products or services are necessary for good health.

Most health plans don’t pay for healthcare services they consider not medically necessary. For example, a cosmetic procedure like Botox to reduce facial wrinkles or tummy-tuck surgery.

Health insurance companies won’t cover procedures that they determine to be experimental or unnecessary. This blog is the perfect place to learn everything about medical necessity letters. You will get the best tips on how to write an effective one with letter of medical necessity template samples.

What is a Medical Necessity?

Health insurance companies use this term to define the coverage under a benefit plan. It is a decision by your health plan that your test, treatment, or procedure is vital to maintain or restore your health condition.

However, the insurance company must consider a medical service that you must cover under its plan. For example, Medicare describes medically necessary as “supplies or services” essential to diagnose or treat a medical condition and meet the standards of a medical practice.

What is a Letter of Medical Necessity?

A medical necessity letter explains why your provider suggests a specific product or treatment for your health. This letter usually considers the patient’s history and information about the medical necessity and duration of the recommended treatment.

Individuals need a letter of medical necessity to reimburse for a product, device, or procedure while using their HSA or FSA. The health insurance company can use this document for expense verification of the diagnosis, treatment, or prevention of a medical condition.

The IRS will only consider the document HSA or FSA eligible if the expenses meet this requirement. For example, if your doctor recommends you take calcium and vitamin D supplements to treat calcium deficiency.

You must have a medical necessity letter to get reimbursement for these items while using your HSA or FSA funds. It is not sure that the IRS will consider a product or service as an eligible expense under an insurance plan.

You must contact your insurance company to understand what comes under your coverage plan. Calling your account custodian can help determine if you own an FSA or HSA. It will help you know which expense would qualify for reimbursement.

Certain items may require a medical necessity letter to get eligible. Here’s a list of products and services that may need a letter of medical necessity;

- Diet pills

- Calcium supplements

- Fluoride toothpaste and rinses

- Iron supplements

- Vitamins

- Weight-loss programs

- Yoga

- Nutritional supplements

- Health clubs

- Air purifiers

- Baby formula

- Birthing classes

- Health clubs

- Homeopathic treatments

- Personal training services

- Fitness trackers

- Birthing classes

Medicare enforces its version of a LOMN, which is a certificate of medical necessity. It is generally applicable for claims involving durable medical equipment (DME), such as;

- Oxygen

- Seat-lift mechanisms

- TENS (Transcutaneous electrical nerve stimulators)

Who Might Need a Letter of Medical Necessity?

Usually, a healthcare provider writes and signs a medical necessity letter. It can help you reimburse the cost of a product or service. However, there’s no 100% guarantee that the IRS will approve the expense.

The following healthcare professionals can issue a medical necessity letter;

- Physicians

- Nurses

- Chiropractors

- Psychologists and psychiatrists

- Physical therapists and occupational therapists

The healthcare provider must be treating you to write this letter. You can also ask your insurance company about their preference for the type of provider to submit this document.

Medical Necessity Letter Terminologies to Learn

Healthcare providers and insurance companies use different terminologies in the medical sector. Here are some vital ones to understand;

Medically Necessary

It refers to the necessary healthcare services or supplies to diagnose or treat a medical condition or injury.

Insurance Appeal Letter

Individuals submit a standard document to explain why the insurance company should pay for a denied claim. They also might need to attach a medical necessity letter to support the appeal submission.

What are the Contents of a Medical Necessity Letter?

Many insurance companies and FSA and HSA account custodians provide medically necessary sample letters. You can refer to a letter of medical necessity template sample to understand the requirements on the websites of:

- HealthyEquity

- United Healthcare

- Aetna

- Astellas Pharma

- Radicava

A general medical necessity letter requires the following information;

- Patient name and medical history

- Diagnosis results

- Reasons behind the need for the product or service

- Treatment duration

- Date of writing the letter

- Provider’s relationship to you

- Contact information and signature

How Should I Use a Letter of Medical Necessity?

People find different use cases for sending a medical necessity letter to insurance companies. This example would be handy for you to understand what information to add and how to submit the letter.

Image your body mass index (BMI) is 33. It indicates you are morbidly obese. Your healthcare provider recommends getting gastric bypass surgery to reduce the size of your stomach. It would lower your caloric intake and control the condition.

However, your insurance company would demand a medical necessity letter for the surgery to qualify you for reimbursement. It is vital to ask your healthcare provider to include the following information in the LOMN:

- A proper diagnosis report showing obesity.

- Include references to studies that prove the effectiveness of gastric bypass surgery.

- A detailed history of your attempts to lose weight through other methods, such as workouts or consuming weight-loss medications.

- Include details about your chronic diseases, including hypertension, diabetes, or sleep deprivation.

The insurance company will review the letter of medical necessity after your submission. You can also apply for an appeal if they deny the claim.

How Can a Medical Necessity Affect Coverage of Your Healthcare Services?

The technicalities of your health plan define how medical necessity impacts which services it will pay for. Usually, health insurance companies pay a part of the bill for services that qualify as medical necessities.

Reviewing the policy documents, you will find a proper section stating “medical necessity” or “necessary services.” The following elements may complete the definition;

- These services are vital for diagnosing, treating, curing, or relief of a health condition, disease, injury, or illness. However, there could be exceptions for clinical trials, experimental, cosmetic, or investigational purposes.

- The product must be critical for diagnosing, treating, curing, or relief of a health condition, injury, or illness.

- It must adhere to the standards of medical care in the community.

The policy documentation may also ask to consider the following;

- The cost-effectiveness of the treatment or product.

- Alternative services or supplies.

- The place where medically necessary services are eligible for reimbursement.

Some insurance companies hire third-party administrators to administer their health benefits. You can refer to the Summary Plan Description to understand the nature of covered services. Each US state can define “medical necessity” differently within their laws or regulations.

How Does a Healthcare Provider Determine "Medical Necessity"?

A doctor’s attestation is the most crucial consideration for a medical necessity letter. They will recommend that a service or product is medically necessary for you. The “certification” or “utilization review” process requires your doctor or other providers to provide a “letter of medical necessity.”

It enables the insurance company to review the requested medical product or service. You can do this before, during, or after the treatment. Experts recommend crafting a “precertification review” before getting a treatment or procedure.

It allows the health insurance plan to determine if the service satisfies the plan’s requirements for medical necessity. They will consider the letter, medical records, and the policies for coverage to consider reimbursement.

The company provides a “concurrent review” during the treatment to determine if the ongoing treatment is medically necessary.

A “retrospective review” occurs after providing the treatment to the individual. Your insurer will examine if the services were medically necessary, experimental, or cosmetic.

How Can Medical Necessity Impact Emergency Services?

Insurers use a “retrospective review” to evaluate emergency cases. They determine if the care is medically necessary for an emergency level of care.

The “prudent layperson” standard is the most popular measure allowing insurers to decide coverage. There’s no need to rely on precertification while using this standard. An individual may get coverage if a layperson believes an emergency exists and a delay in treatment would worsen the condition.

Also Read: Proof of Insurance Letter

Also Read: Proof of Insurance LetterSample Letter of Medical Necessity Template

This sample letter of medical necessity is only for guidance purposes. However, this letter does not guarantee that the health insurance company will provide reimbursement for the medication.

(Date)

(Payer Name)

ATTN: (Contact Title)

(Name of the Contact Person)

(Payer Address)

(City, State, ZIP)

Re: Appeal for Denial of (include drug name)

Patient Name: (Write the first and last name)

Date of Birth: (MM/DD/YYYY)

Subscriber ID Number: (Write Insurance ID Number)

Subscriber Group Number: (Insurance Group Number)

Case ID Number: (Case ID Number)

Dates of Service: (Dates)

Respected, (Contact Person’s Name)

I am writing this letter on my patient’s behalf (Patient’s name) to recommend the medical necessity for treatment with (Drug Name). This letter contains complete information about the patient’s medical history, diagnosis, and a brief of the treatment plan.

Clinical History

We diagnosed that (patient name) has (condition name) as of (date). He/she has been in my care since (date). I had referred him/her to (include physician name) for (describe reason).

(Provide a summary of reasons behind suggesting treatment with (Drug Name). You must mention the patient’s diagnosis, the severity of the condition, prior treatments, the rationale for discontinuation, and other factors in this section).

Treatment Plan

On (mention date), the FDA approved (DRUG Name) the treatment of (medical condition). (Explain the dosage, treatment length, and clinical practice guidelines to support the use (Drug Name)).

Summary

I believe (Drug Name) is medically necessary for this patient and request coverage for this treatment. Please reach me at (physician phone number) if you have any questions or concerns about this case. Thank you for your consideration and time.

Yours Sincerely,

(Mention Physcian’s Name and Credentials)

Enclosures

(Mention all the enclosures, including medical necessity letter, clinical records, prescribing information, diagnostic test results, clinical practice guidelines, and more)

Tips to Draft the Perfect Letter of Medical Necessity

A medical necessity letter can explain the reason and clinical decision-making for suggesting a specific therapy. Experts recommend individuals follow some vital tips to avoid denials by their insurance companies:

- Individuals must familiarize themselves with the plan’s guidelines to avoid denials when submitting the PA request.

- Necessary referrals can help determine the particular setting of the treatment.

- Knowing and meeting all deadlines is essential to submitting PA forms and other vital documents.

- Contact the payer to determine the duration of the authorization.

- Try to be descriptive and precise in the medical necessity letter.

- Vital components of these letters: Full Name, Date of Birth, Insurance ID Number, Insurance Group Number, and Case ID Number (if present).

- A diagnosis report must support the need for a specific product or service.

- The physician should also highlight the severity of a patient’s condition.

- A summary of the patient’s previous treatments would support the medical necessity letter.

- Adding coding information is helpful for the insurance company to conduct its research timely.

- A recommendation summary would be another help for the insurance company.

What is the Right to Appeal?

An appeal process allows patients and their providers to reappear if the insurance company rejects or denies a claim. The Affordable Care Act (ACA) guarantees your right to an external review if your first appeal isn’t successful.

However, this might not be possible for individuals with a grandfathered health plan. An external appeal is still possible if the insurer’s decision comes under the scope of the No Surprises Act.

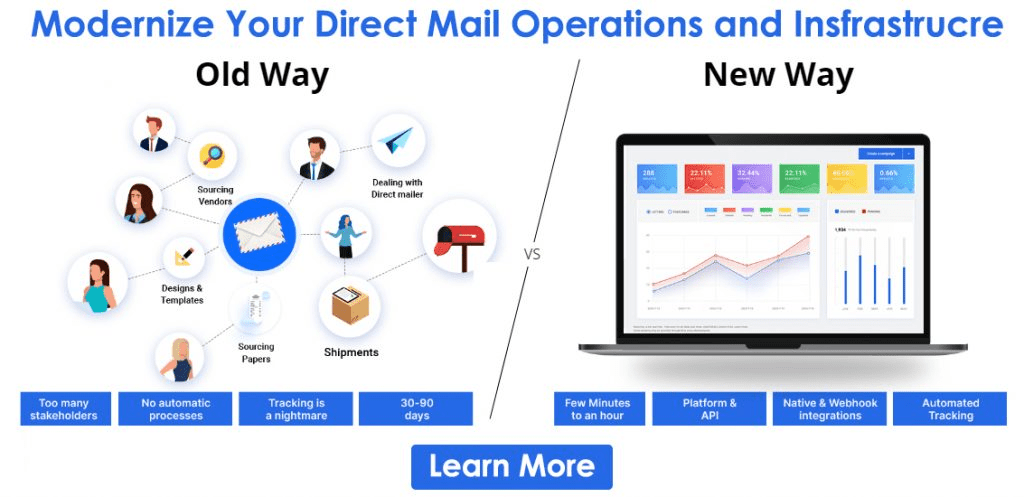

How Can PostGrid Help You Send Medical Necessity Letter?

It could be daunting for physicians and medical settings to manually draft medical necessity letters. They need something automated to reduce their workload and directly send letters to the insurance companies.

PostGrid print and mail API is your best option for automating all medical necessity letters. We take care of everything from printing and mailing the letters to the insurers. You can integrate our API into any existing software stack to enable streamlined workflows.

It has many personalization options, user management tools, and total compliance measures. You get complete documentation to use our direct mail solution.

Sign up to automatically send medical necessity letters.

Ready to Get Started?

Start transforming and automating your offline communications with PostGrid